Spanish Mortgage Calculators

Below you will find a selection of Spanish mortgage calculators to help you work out your payments, eligibility and what property purchase price you should be looking at.

1. Mortgage calculator

Use the sliders, select your mortgage amount, term and rate.

In the green section you will find the results. Monthly payments, total interest payable over the whole term of the loan and the total mortgage amount plus interest.

Mortgage Amount

This is the total you need to borrow. If you are not a resident in Spain then typically the maximum you can borrow is 70% of the purchase price. Spanish residents can borrow up to 80%.

Mortgage Term

The total length of the mortgage in years. The average mortgage in Spain is 20 years, however longer terms up to 40 years are possible. The longer the term, the lower the payments.

Spanish Mortgage Rates

Spanish mortgage interest rates vary. Mortgages in Spain are referenced to the Euribor, which in October 2024 is around 2.7%.

2. Income vs debt calculator

In order to understand how much you can borrow, you need to know what your mortgage score is. Anything over 40% will not qualify.

Debt payments

Credit cards, any loans & mortgages. Also, you need to include your future Spanish mortgage payments for the mortgage on the Spanish property (use the Spanish mortgage calculator to get this figure)

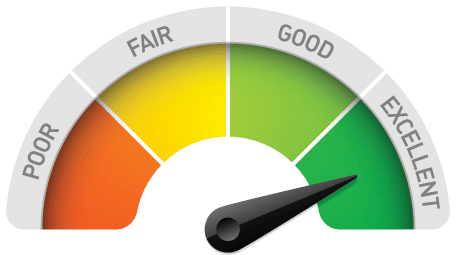

What is my score

Go one step further and find out what your score is and how likely you are to qualify for a mortgage in Spain

3. What is your purchase price?

Simply use the slider to enter how much you have saved towards your purchase and based on a maximum 70% mortgage plus 10% purchase costs the calculator will tell you what your maximum purchase price should be.

How to use the calculators to qualify for a mortgage in Spain

Use the above Spanish mortgage calculators to work out how much you can borrow to purchase your new home in Spain.

Mortgage Calculator

Use the calculator to work out what your monthly payments would be.

Purchase price

Enter the value of the property you would like to buy

Deposit Amount

Enter the % amount you will be paying yourself. If you are a resident of Spain the minimum amount is 20%, if not then it is 30%

Term

Enter the term of the mortgage, the shorter the term the higher the repayments will be.

Mortgage Score

To work out how much you can borrow you need to know what your income to debt score is or mortgage score

What debts?

Credit cards, car loans, home improvement loans & mortgages

What does my score mean?

Banks in Spain will not lend if your income to debt ratio is above 40%, so if your score is above 40 then you will have to increase your income, or pay of some of your debts to get approved

Do not forget

You also need to include your future mortgage payments in your debt to income ratio, use the Spanish mortgage calculator to understand what those payments might be

simple, fast & online applications

Get Answers Fast

We have our own risk team that can quickly evaluate your situation and determine which banks will lend you the most money at the best rates.

5 star service

We work hard for our customers. Applying for a mortgage in a foreign country is not always easy! You can read our reviews online

No upfront fees

There is no charge for submitting an application or receiving an offer. Only once you are happy will you need to pay for any service. View fees here.

Start application

Please complete the form, and schedule a call with the mortgage team

General Mortgage Questions

Documentation, what you can borrow etc

How much can I borrow?

The amount you can borrow depends on your debt to income ratio. Most Spanish lenders will not lend money if your combined outgoings (mortgages & loans) add up to more than 40% of your total income.

We have an in-house risk assessment team, that can help you understand what you can borrow. Get in touch here

Is there a fee to find out what I can borrow?

No, we do not charge to check what you can borrow, or even to get an official offer from one of our lenders. We only charge if you decide to accept an offer from the bank to purchase a property.

Does age effect the loan period?

You can be no older than 75 / 80 years of age when the mortgage completes. If you are 60 years old then the maximum term is 15-20 Years. If you are unsure, get in touch.

What is the maximum LTV (Loan to value)?

Up to 70% for

Up to 80% for Spanish residents

The value of the loan will be based on the property valuation or the property price, whichever is lower.

Can I release equity from my Spanish property?

Releasing equity or remortgaging an existing property in Spain is incredibly difficult since the financial crisis in 2009. It is not impossible, but every situation is different. Please get in touch to find out what your specific situation is

What documents do the banks require?

- Copies of your Passport / NIE (for all parties that will be on the mortgage)

- Your most recent tax declaration or P60

- Your last three payslips

- Details of other properties you own including any potential rental income

- A bank statement of the last 6 month

- An Experian credit report

advice & help

click the button for mortgage, legal & property help