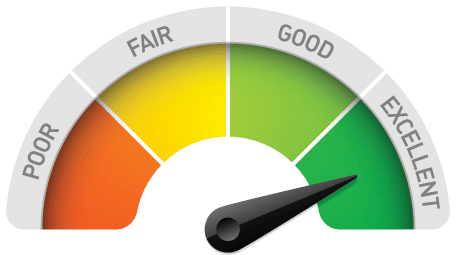

What is my score?

Use the sliders to work out what you can afford to borrow and how you score

How does it work

The way banks score you is different in every country.

In Spain, banks look at your taxed income, and how much debt you manage.

If the amount of debt you manage exceeds 40% of your income then you will find it very hard to qualify for a mortgage in Spain.

Accurate scoring system

Our scoring system takes into account all the relevant figures and produces an accurate % score based on how the banks will score you.

If your score is above 60% then there is a very good chance you will qualify, the higher the score the better your chance to qualify.

key facts

Monthly Income

Your income each month after tax. If you are buying with another person, you can add their income to this figure.

Monthly Debt

Mortgage payments, car loans, credit card bills. Add up how much you pay each month to maintain these debts.

Loan Amount

The maximum LTV (loan to value) you can borrow is 70% if you are a non-tax resident. So the loan figure assumes this total value. If you require less than 70% then this will improve your score.

Purchase Costs

The assumed amount is 10% but this is an estimate and will change depending on where you are buying, the type of property and other factors such as the lawyer you use for the purchase.

Mortgage Term

The normal term of a loan in Spain is between 10-35 years. Regardless your mortgage term must complete before you are 75 years of age. If you are over 65 it is very unlikely you will qualify for a mortgage in Spain.

Working hard for our customers

We are a team of regulated financial consultants and lawyers whose priority is looking after our customer’s best interests. Do not take our word for it, read some of their owns reviews.

Key questions answered

Buying in a foreign country will likely be different from buying in your home country.

Here are some of the questions we get asked the most, but if your question is not covered then our experienced team is on standby to help.

What documents do the banks require?

- Copies of your Passport / NIE (for all parties that will be on the mortgage)

- Your most recent tax declaration or P60

- Your last three payslips

- Details of other properties you own including any potential rental income

- A bank statement of the last 6 month

- An Experian credit report

Is there a fee to find out what I can borrow?

Does age effect the loan period?

What is the maximum LTV (Loan to value)?

Up to 80% for Spanish residents

The value of the loan will be based on the property valuation or the property price, whichever is lower.

Can I release equity from my Spanish property?

advice & help

click the button for mortgage, legal & property help