Terms of Service

Foxes are a mortgage & legal company, our aim is to ensure our customers buying in Spain get the best possible financial terms on their mortgage and are protected and informed for the purchase of their property.

We aim to ensure that our services and customer support is clear and transparent, to ensure you can have complete faith in our company, the team and the services we offer.

These are our terms of service, without the usual legal jargon they should be easier to read and understand than most. If you need any clarification though, please reach out to us at team@foxes.es.

You can also read our privacy policy here and our cookie policy here.

Who are Foxes and what do we do?

Foxes are a Spanish limited company, known as an S.l Our registered company name is Rapido Finance & Legal S.l with the registered company number (CIF) B93533628

We represent you the Client, not the bank or any estate agency and we act in the best interests of the customer relating to the purchase of a property in Spain.

We will endeavour to provide you the Client with a high level of service from start to finish and aim to respond to all questions and requests in a timely and efficient manner.

Our mortgage & legal services are independent from each other and the customer is under no obligation to use either service.

About our mortgage service

Foxes act as independent mortgage brokers. The products we source are at the request of our customers and are based on financial information our customer provides us.

Every mortgage issued in Spain is subject to Ley 5/2019, de 15 de marzo, reguladora de los contratos de crédito inmobiliario you can view the official legislation here.

The financial information provided to us by the customer should be…

- Clearly readable, correctly named to reflect the contents and without password protection.

- It is the client’s responsibility to ensure the information contained within the documentation is from an official source and not falsified in any way.

- Where possible be in English or Spanish, other languages are accepted however the customer may need to provide translations, we will inform you if this is the case.

- If the customer presents information on a second applicant it is assumed they have prior authorisation to share this information.

The customer understands and agrees that any offer issued directly from a Spanish bank or through any intermediatory is in principle and subject to:

- An official valuation, if this valuation highlights any legal issues with the property then the bank may not lend on that specific property.

- Signing all relevant contracts with the bank and agreeing to the terms of the mortgage. If the customer does not sign the relevant contracts or agree to the terms of the mortgage then the bank will not issue the mortgage.

- Further investigation by the bank’s internal risk team, in the event the bank deems it necessary. If the customer does not comply with the requests this may affect the offer.

- If the customer has undisclosed debts, unpaid debts or sanctions against them, this may affect the offer.

- The customer’s financial situation not changing, if during the process the customer loses their job, takes out a loan or changes their debt profile in any way then this may affect the offer.

- A change in mortgage legislation, bank policy or a change in rules from the European central bank.

The customer understands that Foxes is not the financial institution, we have no control over the level of service and support they provide, but in its role as intermediatory, we will ensure the customer is kept up to date throughout the process.

It is the customer’s responsibility to pay for the valuation of the property unless otherwise stated by the lender. The customer understands that Foxes have no influence over the valuation, it is conducted by a 3rd party.

The customer understands if the official value of the property is lower than the asking price, that the LTV of the loan will be based on the value rather than the purchase price. The customer also understands if the property values lower than the asking price, that the customer will need extra funds to compensate and that it is their responsibility to fund this.

If the customer is required to sign any documentation with the lender, but cannot do so then one of the Foxes team can sign on your behalf, but only with express permission by you and with official authorisation given by power of attorney.

If the customer earns income in a currency other than Euros, then they accept that there may be fluctuations in the currency markets, and it is their responsibility to ensure they have sufficient funds to complete the purchase.

If the customer requests or has an offer pending by any financial institution or broker in Spain, then it is the customer’s obligation to inform Foxes. If the customer does not inform Foxes, then by submitting a duplicate file to a financial institution this may affect the original offer, as well as waste time. We urge you to be transparent, to ensure we can provide you with the best service.

The customer understands that the bank, their lawyer and the sellers party have ultimate control over the purchase timeline. If the customer requires the purchase to happen within a restricted timeline they need to communicate this to their legal representative.

The customer understands that any deposit must come from savings or inheritance. It cannot come from any type of loan or by releasing equity from another property and must adhere to Spanish money laundering legislation click here

La Ficha Europea de Información Normalizada (FEIN) & La Ficha de Advertencias Estandarizadas (FiAE). These are documents that the bank must produce and make available to the customer 10 days prior to the purchase date. The customer or an official representative must then visit the notary and sign both documents. Once signed the bank is under obligation by law to issue the loan, until these documents are signed the customer understands that the bank may not issue the loan.

About our legal service

If you chose to use Foxes to be your legal representative during the purchase process, you will be assigned an English speaking lawyer, who is a member of the Spanish bar association.

Your lawyer will advise you on all relevant details regarding the purchase of the property and carry out all relevant checks to ensure the property is legal, complies with Spanish plans, laws and regulations and has the correct habitation license.

Your lawyer will negotiate on your behalf relating to any reservation contract, and private purchase contract. However, it is the customer’s ultimate responsibility to sign any contract, unless you have given power of attorney and give permission to your lawyer to sign on your behalf.

If the customer has signed or signs a reservation agreement either prior to or after nominating Foxes as their legal representative, without prior discussion with their legal representative then they do so at their own risk. If Foxes negotiates a reservation contract on behalf of the customer, it is our duty to inform you of the terms of that agreement prior to signing.

If the customer decides to stop the purchase of the property, they understand that their deposit may be at risk, unless the terms of the reservation contract dictate that their deposit can be refunded.

Foxes are not responsible for any 3rd parties behaviour during the purchase process. If the agent or sellers lawyer acts irresponsibly or provides incorrect information to Foxes or the customer, then Foxes are not responsible for their actions.

Fees

Mortgage fee:

There is no charge to get an offer. If you accept an offer we charge €1,500 + IVA (21%) on acceptance of the mortgage offer and 0.5% +IVA of the mortgage amount once the binding paperwork has been issued.

Legal fee:

1% of the purchase price + IVA with a minimum of €2,500 + IVA. 50% is payable once you instruct Foxes and the balance is due on completion of the purchase.

If there is a legal issue with the property, then the legal services will carry forward to another property. If we are required to carry out legal checks on further properties then there will be a minimum charge of €1,000 + IVA for each additional property.

There are no refunds for either legal services or mortgage services.

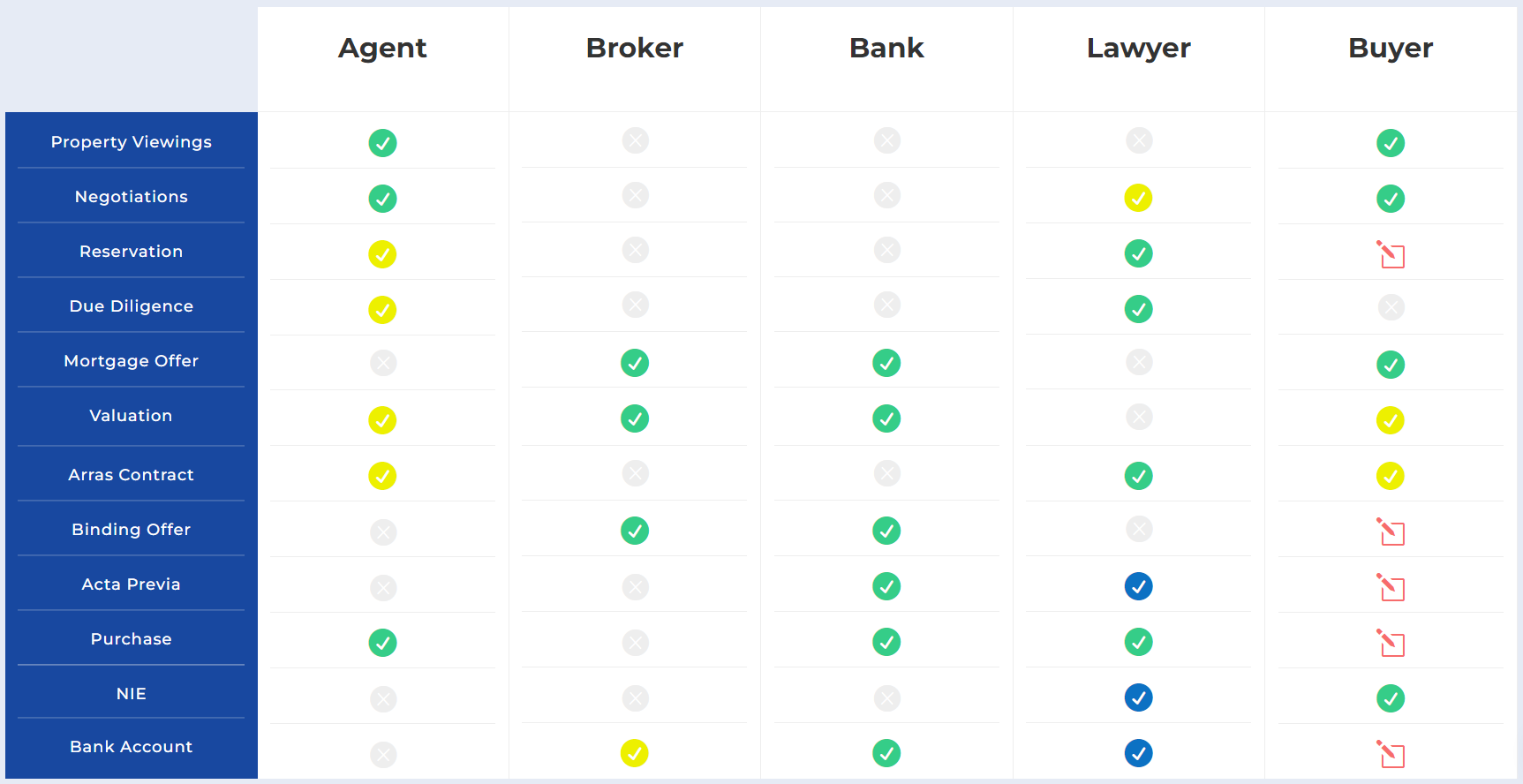

Property Purchase Responsibility Chart

Use the below chart to help you through your property purchase. At each step, one or more parties can be involved or will take responsibility.

Agent

Broker

Bank

Lawyer

Buyer

Property Viewings

Negotiations

Reservation

Due Diligence

Mortgage Offer

Valuation

Arras Contract

Binding Offer

Acta Previa

Purchase

NIE

Bank Account

Responsibility

Can be involved

Can be involved (with power of attorney POA)

Signature required

Not involved

Property viewings

The buyer identifies properties they would like to view and along with the agent will view those properties

Negotiations

Once you have identified the property you wish to purchase, inform the agent and agree a price. If the price is below the asking price, then your agent can help negotiate an agreement.

Reservation

Reserving a property takes the property off the market while you carry out legal checks and qualify for a mortgage if you need finance. A reservation contract should be negotiated by your lawyer to ensure your deposit is protected and you have enough time to complete the checks (due diligence and valuation) and qualify for the mortgage. Deposits range between 3,000 Euros and 1% of the purchase price.

Due dilligence

Due diligence is carried out by your lawyer. This involves checking the property is owned by the seller, has no debts and is legal.

Mortgage offer

This is known as an AIP, agreement in principle. The offer is based on your financial situation and the property you are buying.

Valuation

If you a buying with a mortgage the bank will require a valuation of the property. The Foxes mortgage team will liaise with the agent or owner of the property to organise an appointment for the valuer. Once the valuer has visited the property, it takes around 4-7 working days to receive the report.

Arras contract

The contract de Arras, or private purchase agreement is a private contract between the seller and the buyer where the sale is agreed. Once signed both are locked in to the purchase and can only pull out with a penalty. Your lawyer will negotiate this contract and if they have power of attorney, they can also sign on your behalf.

This contract should not be signed until the due diligence has been completed, and the valuation and mortgage are in place.

Binding offer

The binding offer is presented by the bank, once signed your mortgage offer is binding. This document will only be issued after the valuation and close to the purchase.

Acta previa

This document needs to be signed in a notary by the buyer or their lawyer. The purpose of this document is to check the mortgage complies with the law and the buyer is fully aware of the conditions of the mortgage.

Purchase

The final purchase will be carried out in front of a Spanish notary. In most cases, the bank, seller, sellers lawyer, buyer and or their lawyer will need to present for the signing. Once signed the keys will be handed over to the new onwer.

NIE

An NIE or Número de Identificación de Extranjero is an identification number that any foreign person who is buying a property in Spain will need to request before they begin the purchase process. You can read more about applying here

Bank account

You will need to open a Spanish bank account prior to the purchase. Your broker or lawyer can help you liaise with a bank to do this online, however, you will need to visit a branch of the bank prior to the purchase and present your official documents.

advice & help

click the button for mortgage, legal & property help